Resume Examples

December 12, 2024

12 Treasurer Resume Examples

by Rennie HaylockTake stock of your career potential with these treasurer resume examples.

Build a resume for freeA compelling treasurer resume is essential for standing out from the crowd. Whether you're an aspiring financial professional or a seasoned treasurer looking to advance your career, this comprehensive guide will provide you with valuable insights and treasurer resume examples to help you create a standout application. We'll explore various treasurer roles across different industries and experience levels, offering expert tips on how to write a resume that highlights your financial acumen, leadership skills, and strategic thinking abilities.

Build your treasurer resume today

Use our AI Resume Builder, Interview Prep and Job Search Tools to land your next job.

Treasurer Resume Examples

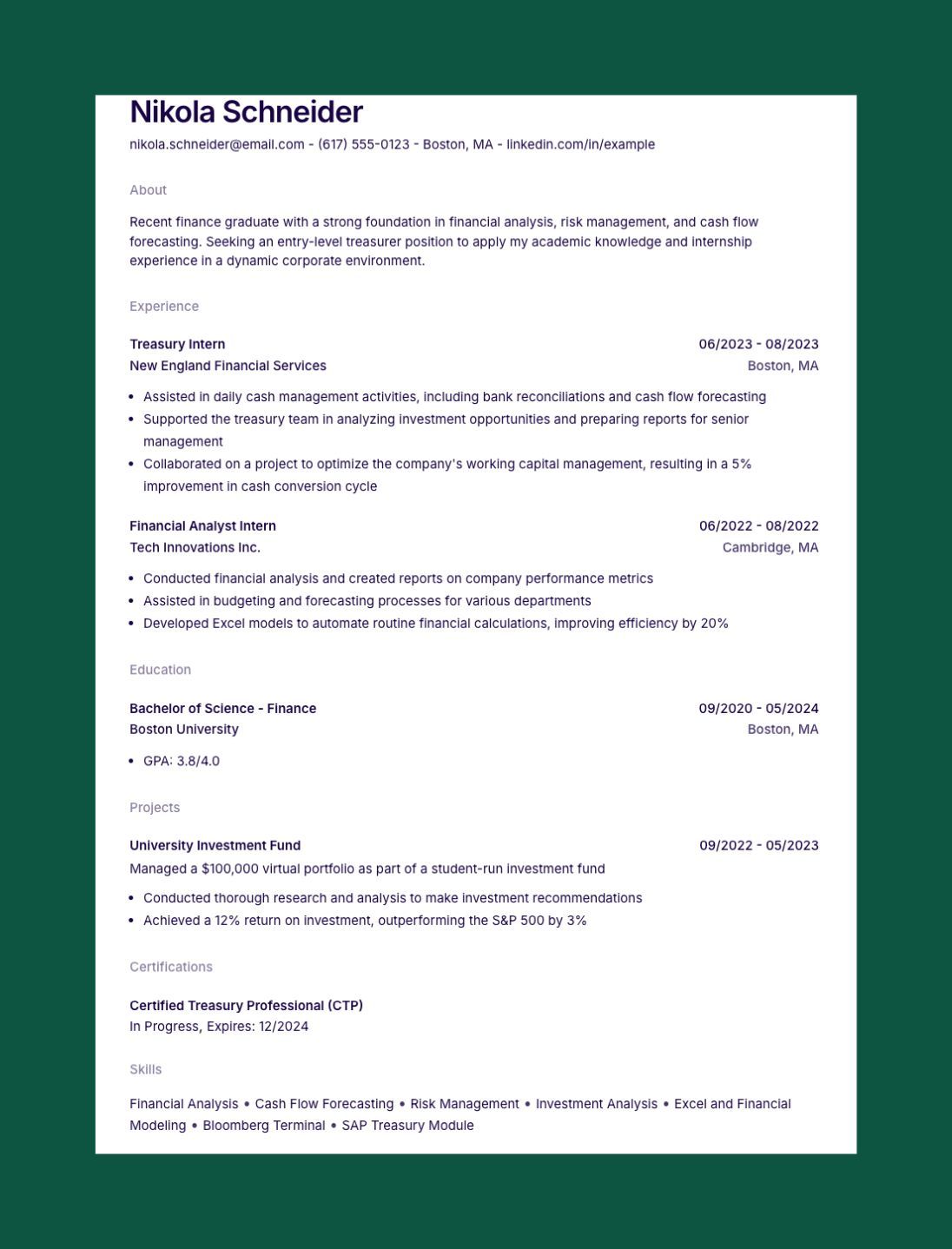

Entry-Level Treasurer Resume

This entry-level treasurer resume example showcases how recent graduates or professionals transitioning into treasury can highlight their relevant skills and education.

Build Your Entry-Level Treasurer ResumeNikola Schneider

[email protected] - (617) 555-0123 - Boston, MA - linkedin.com/in/example

About

Recent finance graduate with a strong foundation in financial analysis, risk management, and cash flow forecasting. Seeking an entry-level treasurer position to apply my academic knowledge and internship experience in a dynamic corporate environment.

Experience

Treasury Intern

New England Financial Services

06/2023 - 08/2023

Boston, MA

- Assisted in daily cash management activities, including bank reconciliations and cash flow forecasting

- Supported the treasury team in analyzing investment opportunities and preparing reports for senior management

- Collaborated on a project to optimize the company's working capital management, resulting in a 5% improvement in cash conversion cycle

Financial Analyst Intern

Tech Innovations Inc.

06/2022 - 08/2022

Cambridge, MA

- Conducted financial analysis and created reports on company performance metrics

- Assisted in budgeting and forecasting processes for various departments

- Developed Excel models to automate routine financial calculations, improving efficiency by 20%

Education

Bachelor of Science - Finance

Boston University

09/2020 - 05/2024

Boston, MA

- GPA: 3.8/4.0

Projects

University Investment Fund

09/2022 - 05/2023

Managed a $100,000 virtual portfolio as part of a student-run investment fund

- Conducted thorough research and analysis to make investment recommendations

- Achieved a 12% return on investment, outperforming the S&P 500 by 3%

Certifications

Certified Treasury Professional (CTP)

Skills

Financial Analysis • Cash Flow Forecasting • Risk Management • Investment Analysis • Excel and Financial Modeling • Bloomberg Terminal • SAP Treasury Module

Why this resume is great

This entry-level treasurer resume effectively showcases the candidate's potential despite limited professional experience. The strong educational background in finance is highlighted, along with relevant internships that demonstrate practical skills in cash management and financial analysis. The inclusion of a student-run investment fund project and volunteer experience in financial literacy adds depth to the resume, illustrating the candidate's passion for finance and ability to apply knowledge in real-world scenarios.

Corporate Treasurer Resume

This corporate treasurer resume example demonstrates how experienced professionals can highlight their strategic financial management skills and achievements.

Build Your Corporate Treasurer ResumeIsabella Torres

[email protected] - (312) 555-7890 - Chicago, IL - linkedin.com/in/example

About

Strategic and results-driven Corporate Treasurer with over 10 years of experience in managing global treasury operations for Fortune 500 companies. Proven track record in optimizing cash management, mitigating financial risks, and driving cost savings through innovative financial strategies.

Experience

Senior Corporate Treasurer

Global Innovations Corp.

07/2018 - Present

Chicago, IL

- Lead a team of 15 treasury professionals, overseeing global cash management, investment strategies, and risk management for a $10B multinational corporation

- Implemented a new treasury management system, resulting in a 30% improvement in cash forecasting accuracy and $5M annual cost savings

- Developed and executed a comprehensive FX hedging strategy, reducing currency risk exposure by 40%

- Negotiated and structured a $2B revolving credit facility, improving liquidity position and reducing interest expenses by $3M annually

Treasury Manager

Midwest Manufacturing Inc.

05/2014 - 06/2018

Detroit, MI

- Managed daily cash operations, investment portfolios, and banking relationships for a $5B manufacturing company

- Led the implementation of a cash pooling structure across 10 countries, optimizing working capital and reducing idle cash by 25%

- Developed and maintained financial models for cash forecasting, resulting in a 15% improvement in forecast accuracy

- Collaborated with IT to enhance treasury systems integration, automating 70% of routine treasury processes

Treasury Analyst

Financial Solutions LLC

06/2011 - 04/2014

New York, NY

- Conducted daily cash positioning and forecasting for multiple client accounts

- Assisted in the development of investment policies and strategies for corporate clients

- Prepared monthly treasury reports and presentations for senior management and board meetings

Education

Master of Business Administration - Finance Concentration

University of Chicago Booth School of Business

09/2009 - 05/2011

Chicago, IL

Bachelor of Science - Economics

New York University

09/2005 - 05/2009

New York, NY

Certifications

Certified Treasury Professional (CTP)

Chartered Financial Analyst (CFA)

Skills

Global Cash Management • Financial Risk Management • Investment Strategy • Bank Relationship Management • Treasury Management Systems • Financial Modeling and Analysis • Foreign Exchange (FX) Hedging • Debt and Capital Management

Why this resume is great

This corporate treasurer resume excellently showcases the candidate's extensive experience and strategic impact in treasury management. The progression from Treasury Analyst to Senior Corporate Treasurer demonstrates career growth and increasing responsibilities. Quantifiable achievements, such as cost savings and risk reduction percentages, provide concrete evidence of the candidate's value. The inclusion of relevant certifications, professional affiliations, and industry awards further strengthens the resume, positioning the candidate as a seasoned and recognized treasury professional.

Nonprofit Treasurer Resume

This nonprofit treasurer resume example illustrates how to highlight financial management skills in a mission-driven context.

Build Your Nonprofit Treasurer ResumeLuca Pappas

[email protected] - (415) 555-3456 - San Francisco, CA - linkedin.com/in/example

About

Dedicated nonprofit finance professional with 8+ years of experience in treasury management and financial stewardship. Passionate about leveraging financial expertise to support organizations in achieving their social missions while ensuring fiscal responsibility and transparency.

Experience

Treasurer

Bay Area Community Foundation

03/2018 - Present

San Francisco, CA

- Oversee financial operations and treasury management for a $100M endowment foundation

- Develop and implement investment strategies aligned with the foundation's mission and risk tolerance, achieving an average annual return of 7.5%

- Lead budgeting and financial planning processes, ensuring efficient allocation of resources across various programs and grants

- Collaborate with the board of directors to establish financial policies and procedures, enhancing transparency and accountability

- Manage relationships with banks, investment advisors, and auditors to optimize financial performance and compliance

Senior Financial Analyst

Eco Solutions Nonprofit

06/2015 - 02/2018

Oakland, CA

- Managed cash flow and investment activities for a $20M environmental nonprofit

- Developed financial models and forecasts to support strategic decision-making and program expansion

- Implemented a new fund accounting system, improving financial reporting efficiency by 40%

- Prepared and presented monthly financial reports to the executive team and board of directors

Financial Coordinator

Youth Empowerment Organization

09/2012 - 05/2015

Berkeley, CA

- Assisted in daily financial operations, including accounts payable, accounts receivable, and grant management

- Supported the annual budgeting process and monitored program expenses against budgets

- Helped prepare financial statements and reports for funders and regulatory agencies

Education

Master of Public Administration - Nonprofit Management Concentration

University of San Francisco

09/2010 - 05/2012

San Francisco, CA

Bachelor of Arts - Economics

University of California, Berkeley

09/2006 - 05/2010

Berkeley, CA

Certifications

Certified Nonprofit Accounting Professional (CNAP)

Chartered Financial Analyst (CFA)

Skills

Nonprofit Financial Management • Endowment Management • Investment Strategy • Fund Accounting • Grant Financial Management • Budgeting and Forecasting • Financial Reporting and Analysis • Donor Relations

Why this resume is great

This nonprofit treasurer resume effectively combines financial expertise with a commitment to mission-driven work. The candidate's progression from Financial Coordinator to Treasurer demonstrates growing responsibility in nonprofit finance. The resume highlights specific achievements, such as investment returns and efficiency improvements, that are particularly relevant to nonprofit organizations. The inclusion of certifications specific to nonprofit accounting, along with volunteer experience and awards, reinforces the candidate's dedication to the sector and expertise in nonprofit financial management.

Government Treasurer Resume

This government treasurer resume example showcases how to highlight public sector financial management experience and achievements.

Build Your Government Treasurer ResumeHiro Kim

[email protected] - (916) 555-7890 - Sacramento, CA - linkedin.com/in/example

About

Experienced government finance professional with 12+ years of expertise in public sector treasury management, budget administration, and financial policy development. Committed to ensuring fiscal responsibility, transparency, and efficient use of public funds to serve community needs.

Experience

City Treasurer

City of Sacramento, CA

08/2017 - Present

Sacramento, CA

- Manage and safeguard the city's $1.2B investment portfolio, consistently achieving returns above the benchmark while maintaining safety and liquidity

- Oversee cash management operations for all city departments, implementing efficient systems that reduced processing time by 25%

- Lead a team of 20 finance professionals in treasury, revenue collection, and debt management functions

- Developed and implemented a comprehensive debt management policy, resulting in an upgrade of the city's credit rating to AA+

- Collaborate with city council and department heads to align financial strategies with long-term city development plans

Deputy Treasurer

State of California, Department of Treasury

06/2012 - 07/2017

Sacramento, CA

- Assisted in managing the state's $100B+ investment portfolio, focusing on compliance with state regulations and investment policies

- Coordinated with various state agencies to forecast cash flow needs and optimize investment strategies

- Led initiatives to modernize treasury operations, including the implementation of a new treasury management system

- Prepared and presented monthly investment reports to the State Treasurer and investment advisory board

Senior Financial Analyst

County of Alameda

09/2009 - 05/2012

Oakland, CA

- Conducted financial analysis and reporting for county treasury operations

- Assisted in the development and monitoring of the county's annual budget

- Participated in debt issuance processes and maintained relationships with rating agencies

Education

Master of Public Administration

University of Southern California

09/2007 - 05/2009

Los Angeles, CA

Bachelor of Science - Finance

University of California, Davis

09/2003 - 05/2007

Davis, CA

Certifications

Certified Government Financial Manager (CGFM)

Certified Public Finance Officer (CPFO)

Skills

Government Treasury Management • Public Sector Investing • Cash Flow Forecasting and Management • Debt Issuance and Management • Financial Policy Development • Budget Administration • Intergovernmental Finance • Public Financial Reporting (GASB)

Why this resume is great

This government treasurer resume effectively showcases the candidate's extensive experience in public sector finance. The progression from county to state to city treasurer roles demonstrates a strong career trajectory in government finance. Specific achievements, such as investment portfolio performance and credit rating improvements, highlight the candidate's impact. The inclusion of relevant certifications, professional affiliations, and community involvement reinforces the candidate's commitment to public service and financial stewardship. The resume also emphasizes key skills specific to government finance, such as GASB reporting and intergovernmental finance.

Senior Treasurer Resume

This senior treasurer resume example demonstrates how to highlight extensive experience and strategic financial leadership.

Build Your Senior Treasurer ResumeYusuf Khan

[email protected] - (212) 555-1234 - New York, NY - linkedin.com/in/example

About

Seasoned treasury executive with 20+ years of experience in global financial operations and strategic leadership. Proven track record in optimizing capital structure, managing complex financial risks, and driving organizational growth through innovative treasury solutions.

Experience

Executive Vice President & Global Treasurer

Worldwide Enterprises Inc.

01/2015 - Present

New York, NY

- Lead global treasury operations for a Fortune 100 company with $50B+ annual revenue across 60+ countries

- Develop and execute capital management strategies, resulting in $500M+ annual interest savings and improved capital efficiency

- Spearhead digital transformation of treasury operations, implementing AI-driven cash forecasting and blockchain-based cross-border payments

- Manage $10B+ in corporate debt and maintain strong relationships with credit rating agencies, resulting in a credit rating upgrade to AA

- Oversee a team of 50+ treasury professionals across multiple regions, fostering a culture of innovation and continuous improvement

Senior Vice President, Treasury

Global Financial Services Corp.

03/2009 - 12/2014

London, UK

- Directed treasury and capital markets activities for a leading international bank

- Led the restructuring of the bank's liquidity management framework post-financial crisis, strengthening the balance sheet and reducing funding costs by 15%

- Developed and implemented a comprehensive FX hedging strategy, reducing earnings volatility by 30%

- Played a key role in several strategic M&A transactions, managing due diligence and integration of treasury operations

Treasurer

Tech Innovations Ltd.

06/2003 - 02/2009

San Francisco, CA

- Established and built the treasury function for a rapidly growing tech company

- Managed IPO process from a treasury perspective, including roadshow support and investor relations

- Implemented treasury management systems and processes to support company growth from $100M to $2B in annual revenue

Education

Master of Business Administration, Finance

Harvard Business School

09/2001 - 05/2003

Boston, MA

Bachelor of Science in Economics and Mathematics

Massachusetts Institute of Technology

09/1997 - 05/2001

Cambridge, MA

Certifications

Certified Treasury Professional (CTP)

Financial Risk Manager (FRM)

Skills

Strategic Financial Leadership • Global Treasury Management • Capital Structure Optimization • Risk Management and Hedging Strategies • Mergers & Acquisitions • Investor Relations • Financial Technology Integration • Regulatory Compliance (Basel III, Dodd-Frank)

Why this resume is great

This senior treasurer resume exemplifies a high-level financial executive with global experience. The career progression showcases increasing responsibilities and strategic impact across diverse industries. Quantifiable achievements, such as interest savings and risk reduction, demonstrate the candidate's ability to drive significant financial improvements. The resume effectively highlights leadership skills, including team management and fostering innovation. The inclusion of speaking engagements and industry awards positions the candidate as a thought leader in treasury management. The emphasis on digital transformation and fintech integration also shows the candidate's forward-thinking approach to treasury operations.

Financial Services Treasurer Resume

This financial services treasurer resume example illustrates how to showcase specialized experience in managing treasury operations within the banking and finance sector.

Build Your Financial Services Treasurer ResumeLaura Fischer

[email protected] - (704) 555-6789 - Charlotte, NC - linkedin.com/in/example

About

Dynamic financial services treasurer with 15+ years of experience in bank treasury management, regulatory compliance, and balance sheet optimization. Adept at navigating complex financial landscapes and implementing innovative strategies to enhance liquidity, funding, and risk management for financial institutions.

Experience

SVP & Treasurer

Atlantic Regional Bank

04/2016 - Present

Charlotte, NC

- Lead treasury operations for a $50B regional bank, overseeing liquidity management, funding strategies, and interest rate risk management

- Developed and executed a comprehensive balance sheet strategy, improving net interest margin by 20 bps and ROE by 150 bps

- Implemented an advanced funds transfer pricing (FTP) system, enhancing profitability measurement and product pricing across business lines

- Spearheaded the bank's LIBOR transition strategy, ensuring seamless adoption of alternative reference rates

- Manage relationships with regulators, rating agencies, and investors, maintaining strong capital and liquidity positions

Director of Asset Liability Management

National Finance Corporation

07/2011 - 03/2016

New York, NY

- Led the asset-liability management (ALM) function for a $100B diversified financial services company

- Developed and maintained complex financial models for interest rate risk, liquidity risk, and capital adequacy analysis

- Chaired the Asset Liability Committee (ALCO), providing strategic recommendations on balance sheet management to senior executives

- Collaborated with business units to optimize product pricing and design, aligning with the company's risk appetite and profitability goals

Treasury Manager

Investment Bank LLC

09/2006 - 06/2011

Chicago, IL

- Managed daily liquidity operations and short-term funding for the bank's trading activities

- Developed cash flow forecasting models, improving accuracy by 30% and optimizing cash utilization

- Assisted in the implementation of Basel III liquidity requirements, including LCR and NSFR calculations

Education

Master of Science - Financial Engineering

Columbia University

09/2004 - 05/2006

New York, NY

Bachelor of Science - Mathematics and Economics

University of Michigan

09/2000 - 05/2004

Ann Arbor, MI

Certifications

Certified Treasury Professional (CTP)

Financial Risk Manager (FRM)

Skills

Bank Treasury Management • Asset Liability Management (ALM) • Regulatory Compliance (Basel III, Dodd-Frank) • Interest Rate Risk Management • Liquidity Risk Management • Funds Transfer Pricing (FTP) • Capital Planning and Stress Testing • Financial Modeling and Analytics

Why this resume is great

This financial services treasurer resume effectively showcases the candidate's specialized expertise in bank treasury management. The career progression demonstrates increasing responsibility and strategic impact within the financial services sector. Specific achievements, such as improving net interest margin and implementing advanced systems, highlight the candidate's ability to drive financial performance. The resume emphasizes key skills crucial for bank treasury, including regulatory compliance, ALM, and risk management. The inclusion of publications and speaking engagements positions the candidate as a thought leader in the field, while professional certifications and affiliations reinforce their industry expertise.

Healthcare Treasurer Resume

This healthcare treasurer resume example demonstrates how to highlight financial management skills specific to the healthcare industry.

Build Your Healthcare Treasurer ResumeSantiago Sanchez

[email protected] - (713) 555-2345 - Houston, TX - linkedin.com/in/example

About

Strategic healthcare finance professional with 10+ years of experience in treasury management for large healthcare systems. Expertise in optimizing cash flow, managing investment portfolios, and implementing financial strategies to support quality patient care and organizational growth in a rapidly evolving healthcare landscape.

Experience

Treasurer

Texas Medical Center

06/2017 - Present

Houston, TX

- Oversee treasury operations for a $5B healthcare system, including 5 hospitals and 50+ outpatient facilities

- Manage a $1.5B investment portfolio, consistently achieving returns 50 bps above benchmark while maintaining appropriate liquidity for operations

- Led the implementation of a centralized cash management system, improving working capital efficiency by 15% and reducing bank fees by $500K annually

- Developed and executed a comprehensive debt management strategy, including the successful issuance of $750M in tax-exempt bonds to fund capital projects

- Collaborate with CFO and Board of Directors to align treasury strategies with long-term organizational goals and healthcare industry trends

Assistant Treasurer

Midwest Healthcare Network

08/2013 - 05/2017

Chicago, IL

- Managed daily cash operations and short-term investments for a $3B multi-state healthcare system

- Implemented a new treasury workstation, automating cash positioning and improving forecast accuracy by 25%

- Developed financial models to analyze the impact of value-based care initiatives on cash flow and working capital requirements

- Assisted in the integration of treasury operations for newly acquired hospitals and clinics

Senior Financial Analyst

City General Hospital

09/2010 - 07/2013

New York, NY

- Conducted financial analysis and reporting for hospital treasury operations

- Assisted in the development and monitoring of capital budgets for major medical equipment purchases

- Supported the treasury team in cash forecasting and investment management activities

Education

Master of Health Administration

Columbia University

09/2008 - 05/2010

New York, NY

Bachelor of Science - Finance

New York University

09/2004 - 05/2008

New York, NY

Certifications

Certified Treasury Professional (CTP)

Certified Healthcare Financial Professional (CHFP)

Skills

Healthcare Treasury Management • Investment Portfolio Management • Debt Issuance and Management • Cash Flow Optimization • Working Capital Management • Financial Risk Management • Healthcare Reimbursement Analysis • Capital Budgeting and Planning

Why this resume is great

This healthcare treasurer resume effectively combines financial expertise with industry-specific knowledge. The candidate's career progression shows increasing responsibility in healthcare finance, from a hospital setting to a large healthcare system. Specific achievements, such as investment performance and working capital improvements, demonstrate the ability to drive financial results in a healthcare context. The resume highlights key skills relevant to healthcare treasury, including reimbursement analysis and value-based care considerations. The inclusion of healthcare-specific certifications, publications, and speaking engagements positions the candidate as a knowledgeable professional in the intersection of finance and healthcare.

Education Sector Treasurer Resume

This education sector treasurer resume example showcases financial management skills tailored to educational institutions.

Build Your Education Sector Treasurer ResumeClara Novak

[email protected] - (617) 555-8901 - Boston, MA - linkedin.com/in/example

About

Dedicated education finance professional with 12+ years of experience in treasury management for higher education institutions. Skilled in endowment management, capital planning, and developing financial strategies to support academic excellence and long-term institutional sustainability.

Experience

University Treasurer

Northeastern University

08/2016 - Present

Boston, MA

- Oversee treasury operations and financial strategy for a major research university with a $1.5B annual budget and $1B endowment

- Manage the university's debt portfolio, including the successful issuance of $300M in tax-exempt bonds to fund campus expansion projects

- Lead a team of 15 finance professionals in cash management, investment operations, and financial planning

- Implemented a comprehensive enterprise risk management framework, enhancing the university's financial resilience

- Collaborate with the Board of Trustees, senior administration, and academic leaders to align financial strategies with the university's mission and strategic plan

Associate Treasurer

University of Illinois System

06/2011 - 07/2016

Champaign, IL

- Managed treasury operations for a multi-campus university system with a $6B operating budget

- Oversaw the system's $2.5B investment portfolio, consistently achieving returns above peer benchmarks

- Developed and implemented cash management strategies to optimize working capital across three campuses

- Led initiatives to improve financial transparency and reporting to stakeholders, including the creation of an interactive financial dashboard

Senior Financial Analyst

Harvard University

09/2008 - 05/2011

Cambridge, MA

- Conducted financial analysis and reporting for university treasury operations

- Assisted in the management of the university's short-term investment pool

- Supported the treasury team in cash forecasting and liquidity management activities

Education

Master of Business Administration

Harvard Business School

09/2006 - 05/2008

Boston, MA

Bachelor of Arts - Economics

Yale University

09/2002 - 05/2006

New Haven, CT

Certifications

Certified Treasury Professional (CTP)

Chartered Financial Analyst (CFA)

Skills

Higher Education Treasury Management • Endowment Management • Debt Issuance and Management • Capital Planning and Budgeting • Investment Portfolio Management • Financial Risk Management • Grant and Research Fund Management • Student Financial Services Integration

Why this resume is great

This education sector treasurer resume effectively showcases the candidate's expertise in higher education finance. The career progression demonstrates increasing responsibility and strategic impact within prestigious educational institutions. Specific achievements, such as successful bond issuances and investment performance, highlight the candidate's ability to manage complex financial operations in an academic setting. The resume emphasizes key skills crucial for university treasury management, including endowment management and capital planning. The inclusion of publications and speaking engagements positions the candidate as a thought leader in education finance, while professional certifications and affiliations reinforce their industry expertise.

Tech Industry Treasurer Resume

This tech industry treasurer resume example demonstrates how to highlight financial management skills in a fast-paced, innovative sector.

Build Your Tech Industry Treasurer ResumeYusuf Mohammed

[email protected] - (415) 555-6789 - San Francisco, CA - linkedin.com/in/example

About

Dynamic tech industry finance professional with 10+ years of experience in treasury management for high-growth technology companies. Expertise in scaling treasury operations, managing global cash flows, and implementing cutting-edge fintech solutions to support rapid business expansion and innovation.

Experience

Director of Treasury

TechNova Inc.

03/2018 - Present

San Francisco, CA

- Lead treasury operations for a unicorn SaaS company with $1B+ annual revenue and operations in 30+ countries

- Developed and executed a comprehensive treasury transformation strategy, leveraging AI and blockchain technologies to automate 80% of routine treasury processes

- Implemented a global cash pooling structure, optimizing working capital and reducing idle cash by 40%

- Managed the company's $500M investment portfolio, consistently achieving returns 75 bps above benchmark while maintaining appropriate liquidity

- Led treasury due diligence and integration for 5 strategic acquisitions, ensuring seamless financial operations post-merger

Treasury Manager

Cloud Solutions Corp.

06/2014 - 02/2018

Seattle, WA

- Managed daily cash operations and short-term investments for a rapidly growing cloud computing company

- Implemented a new treasury management system, improving cash visibility and forecast accuracy by 35%

- Developed and executed FX hedging strategies to mitigate currency risk in international operations

- Supported the company's IPO process from a treasury perspective, including cash management for the offering and investor relations support

Senior Treasury Analyst

E-commerce Giants

09/2011 - 05/2014

San Jose, CA

- Conducted financial analysis and reporting for corporate treasury operations

- Assisted in the management of banking relationships and cash management structures

- Supported the implementation of a new payment gateway system, improving transaction processing efficiency by 20%

Education

Master of Science - Financial Engineering

University of California

09/2009 - 05/2011

Berkeley, CA

Bachelor of Science - Computer Science and Mathematics

Stanford University

09/2005 - 05/2009

Stanford, CA

Certifications

Certified Treasury Professional (CTP)

Financial Risk Manager (FRM)

Skills

Tech Industry Treasury Management • Global Cash Management • Fintech Integration and Implementation • Investment Portfolio Management • Foreign Exchange Risk Management • M&A Financial Integration • Cryptocurrency and Blockchain Applications • API-based Banking and Payment Systems

Why this resume is great

This tech industry treasurer resume effectively showcases the candidate's expertise in managing treasury operations for high-growth technology companies. The career progression demonstrates increasing responsibility and strategic impact within the tech sector. Specific achievements, such as implementing innovative fintech solutions and optimizing global cash management, highlight the candidate's ability to drive financial efficiency in a fast-paced environment. The resume emphasizes key skills crucial for tech industry treasury, including cryptocurrency knowledge and API-based banking systems. The inclusion of publications and speaking engagements positions the candidate as a thought leader in the intersection of finance and technology.

Manufacturing Treasurer Resume

This manufacturing treasurer resume example illustrates how to highlight financial management skills specific to the manufacturing industry.

Build Your Manufacturing Treasurer ResumeOlivia Chen

[email protected] - (313) 555-2345 - Detroit, MI - linkedin.com/in/example

About

Strategic manufacturing finance professional with 15+ years of experience in treasury management for global manufacturing companies. Expertise in optimizing working capital, managing complex supply chain financing, and implementing financial strategies to support operational efficiency and international expansion.

Experience

Global Treasurer

Automotive Innovations Corp.

05/2016 - Present

Detroit, MI

- Lead treasury operations for a $20B global automotive parts manufacturer with operations in 25 countries

- Developed and implemented a comprehensive working capital optimization program, improving cash conversion cycle by 15 days and freeing up $300M in cash

- Structured and executed a $1.5B syndicated revolving credit facility to support global operations and strategic initiatives

- Implemented an advanced supply chain finance program, providing $500M in annual early payments to suppliers while extending DPO by 30 days

- Manage a team of 30 treasury professionals across multiple regions, fostering a culture of continuous improvement and innovation

Director of Treasury

Industrial Solutions Inc.

08/2011 - 04/2016

Chicago, IL

- Oversaw treasury operations for a $5B diversified industrial manufacturer

- Led the implementation of a global cash pooling structure, reducing external borrowing needs by $200M

- Developed and executed FX hedging strategies, mitigating currency risk exposure by 60%

- Played a key role in multiple international acquisitions, managing due diligence and post-merger treasury integration

Treasury Manager

Global Electronics Manufacturing

06/2006 - 07/2011

San Jose, CA

- Managed daily cash operations and short-term investments for a multinational electronics manufacturer

- Implemented a new treasury workstation, improving cash visibility and forecast accuracy by 40%

- Supported the company's expansion into emerging markets, establishing efficient banking structures and cash management processes

Education

Master of Business Administration - Finance Concentration

University of Chicago Booth School of Business

09/2004 - 05/2006

Chicago, IL

Bachelor of Science - Industrial Engineering

Purdue University

09/2000 - 05/2004

West Lafayette, IN

Certifications

Certified Treasury Professional (CTP)

Chartered Financial Analyst (CFA)

Skills

Manufacturing Industry Treasury Management • Working Capital Optimization • Supply Chain Finance • Global Cash Management • Foreign Exchange Risk Management • Debt and Capital Structure Management • Treasury Technology Implementation • Mergers & Acquisitions Financial Integration

Why this resume is great

This manufacturing treasurer resume effectively showcases the candidate's expertise in managing treasury operations for global manufacturing companies. The career progression demonstrates increasing responsibility and strategic impact within the manufacturing sector. Specific achievements, such as working capital optimization and supply chain finance implementation, highlight the candidate's ability to drive financial efficiency in a complex industrial environment. The resume emphasizes key skills crucial for manufacturing treasury, including supply chain finance and foreign exchange risk management. The inclusion of publications and speaking engagements positions the candidate as a thought leader in manufacturing finance, while the volunteer experience demonstrates a commitment to community development and education.

Retail Treasurer Resume

This retail treasurer resume example demonstrates how to highlight financial management skills specific to the retail industry.

Build Your Retail Treasurer ResumeMarcus Taylor

[email protected] - (212) 555-7890 - New York, NY - linkedin.com/in/example

About

Dynamic retail finance professional with 12+ years of experience in treasury management for multinational retail corporations. Expertise in optimizing cash flow, managing seasonal liquidity needs, and implementing innovative payment solutions to enhance customer experience and operational efficiency in the fast-paced retail environment.

Experience

Senior Vice President & Treasurer

Global Retail Enterprises

09/2017 - Present

New York, NY

- Lead treasury operations for a $30B multinational retail corporation with 5,000+ stores across 20 countries

- Developed and implemented a comprehensive cash management strategy, improving working capital efficiency by $500M and reducing borrowing costs by $25M annually

- Spearheaded the adoption of mobile payment and digital wallet solutions across all stores, increasing customer satisfaction and reducing transaction costs by 15%

- Structured and executed a $2B revolving credit facility to support global operations and e-commerce expansion

- Manage a team of 40 treasury professionals, fostering a culture of innovation and continuous improvement in retail finance

Director of Treasury

Fashion Retail Group

06/2013 - 08/2017

Los Angeles, CA

- Oversaw treasury operations for a $10B fashion retail company with a significant e-commerce presence

- Implemented an advanced cash forecasting model, improving accuracy by 30% and optimizing liquidity management during peak retail seasons

- Led the integration of treasury operations for newly acquired brands, standardizing processes across the group

- Developed and executed FX hedging strategies to mitigate currency risk in international operations

Treasury Manager

Luxury Goods Corporation

08/2009 - 05/2013

Chicago, IL

- Managed daily cash operations and short-term investments for a high-end retail company

- Implemented a new treasury workstation, automating cash positioning and improving visibility across multiple brands

- Supported the company's expansion into emerging markets, establishing efficient banking structures and payment processing systems

Education

Master of Business Administration - Finance Concentration

Northwestern University Kellogg School of Management

09/2007 - 05/2009

Evanston, IL

Bachelor of Science in Finance

University of Pennsylvania

09/2003 - 05/2007

Philadelphia, PA

Certifications

Certified Treasury Professional (CTP)

Chartered Financial Analyst (CFA)

Skills

Retail Industry Treasury Management • Seasonal Cash Flow Management • Working Capital Optimization • Payment Systems and Digital Wallets • Inventory Financing • Foreign Exchange Risk Management • E-commerce Financial Operations • Retail Banking Relationship Management

Why this resume is great

This retail treasurer resume effectively showcases the candidate's expertise in managing treasury operations for large retail corporations. The career progression demonstrates increasing responsibility and strategic impact within the retail sector. Specific achievements, such as working capital optimization and innovative payment solutions implementation, highlight the candidate's ability to drive financial efficiency in a dynamic retail environment. The resume emphasizes key skills crucial for retail treasury, including seasonal cash flow management and e-commerce financial operations. The inclusion of publications and speaking engagements positions the candidate as a thought leader in retail finance, while the volunteer experience demonstrates a commitment to financial education and community development.

Small Business Treasurer Resume

This small business treasurer resume example illustrates how to highlight financial management skills tailored to the unique needs of small and medium-sized enterprises.

Build Your Small Business Treasurer ResumeEmma Rodriguez

[email protected] - (512) 555-3456 - Austin, TX - linkedin.com/in/example

About

Versatile small business finance professional with 8+ years of experience in treasury management for growing enterprises. Adept at optimizing cash flow, securing financing, and implementing cost-effective financial solutions to support business growth and sustainability in resource-constrained environments.

Experience

Treasurer & Finance Director

TechStart Innovations

04/2018 - Present

Austin, TX

- Oversee all financial operations for a rapidly growing tech startup, managing cash flow, investments, and financial planning

- Secured $5M in venture capital funding and negotiated a $2M line of credit to support product development and market expansion

- Implemented a cloud-based treasury management system, improving cash visibility and reducing manual processes by 70%

- Developed and executed a comprehensive financial strategy that supported company growth from $1M to $15M in annual revenue

- Lead a lean finance team of 5 professionals, fostering a culture of efficiency and continuous improvement

Senior Financial Analyst

GrowthCap Partners

06/2015 - 03/2018

Dallas, TX

- Provided financial advisory services to small and medium-sized businesses across various industries

- Conducted financial analysis and developed cash flow projections for clients seeking growth capital

- Assisted in structuring debt and equity financing deals for high-potential startups and established SMEs

Treasury Specialist

Local Retail Group

08/2013 - 05/2015

Houston, TX

- Managed cash operations and banking relationships for a group of 10 local retail stores

- Implemented cash forecasting tools, improving working capital management and reducing overdraft fees by 90%

- Assisted in negotiating merchant services agreements, reducing transaction costs by 15%

Education

Master of Science - Finance

University of Texas at Austin

09/2011 - 05/2013

Austin, TX

Bachelor of Business Administration - Accounting

Texas A&M University

09/2007 - 05/2011

College Station, TX

Certifications

Certified Treasury Professional (CTP)

Certified Management Accountant (CMA)

Skills

Small Business Treasury Management • Cash Flow Optimization • Venture Capital and Debt Financing • Financial Planning and Analysis • Working Capital Management • Banking Relationship Management • QuickBooks and Xero Expertise • Financial Technology Integration

Why this resume is great

This small business treasurer resume effectively showcases the candidate's expertise in managing financial operations for growing enterprises. The career progression demonstrates versatility across different aspects of small business finance, from startup environments to advisory roles. Specific achievements, such as securing venture capital funding and implementing cost-effective financial solutions, highlight the candidate's ability to drive growth and efficiency in resource-constrained settings. The resume emphasizes key skills crucial for small business treasury, including cash flow optimization and financial technology integration. The inclusion of publications and speaking engagements positions the candidate as a knowledgeable professional in small business finance, while the volunteer experience demonstrates a commitment to supporting local entrepreneurs.

How to Write a Treasurer Resume

Treasurer Resume Outline

A well-structured treasurer resume should include the following key sections:

- Contact Information: Full name, city, state, phone number, email, and LinkedIn profile

- Professional Summary or Objective: A brief overview of your experience, skills, and career goals

- Work Experience: Detailed information about your relevant work history, including job titles, companies, dates of employment, and key responsibilities and achievements

- Education: Your academic qualifications, including degrees, institutions, and graduation dates

- Skills: A list of relevant technical and soft skills

- Certifications: Any professional certifications relevant to treasury management

- Professional Affiliations: Memberships in relevant professional organizations

- Awards and Achievements: Recognition for your professional accomplishments

- Additional Sections (optional): Publications, speaking engagements, or volunteer experience related to finance or treasury management

Which Resume Layout Should a Treasurer Use?

For most treasurer positions, a reverse-chronological resume layout is recommended. This format highlights your most recent and relevant experience first, which is typically what employers are most interested in. However, if you're changing careers or have gaps in your employment history, a combination resume format might be more suitable. This format allows you to emphasize your skills and qualifications while still presenting your work history.

What Your Treasurer Resume Header Should Include

Your treasurer resume header should be concise and professional, containing essential contact information. Here are some good and bad examples:

Emma Rodriguez

[email protected] - (512) 555-3456 - Austin, TX - linkedin.com/in/example

Why it works

- Full name is clearly displayed at the top - Location is limited to city and state, which is sufficient for most job applications - Phone number and email address are included for easy contact - LinkedIn profile URL is provided, offering additional professional information

Emma Rodriguez

[email protected] - Austin, TX 78701

Bad example

- Full street address is unnecessary and takes up valuable space - Phone number is missing, which could make it difficult for employers to contact you - LinkedIn profile is not included, missing an opportunity to showcase your professional network and additional information

What Your Treasurer Resume Summary Should Include

A strong treasurer resume summary should concisely highlight your most relevant qualifications, experience, and achievements. It should give potential employers a quick overview of why you're an ideal candidate for the position. Here are key elements to include:

- Years of experience in treasury management or related fields

- Specific areas of expertise within treasury (e.g., cash management, risk management, investment strategy)

- Notable achievements or contributions in previous roles

- Relevant skills or certifications

- Industry-specific experience, if applicable

Treasurer Resume Summary Examples

About

Strategic treasurer with 10+ years of experience in global cash management and financial risk mitigation for Fortune 500 companies. Expertise in optimizing working capital, implementing treasury management systems, and developing innovative financial strategies. Successfully led treasury operations resulting in $50M annual cost savings and 30% improvement in cash flow forecasting accuracy. CTP certified with a proven track record of aligning treasury functions with overall business objectives.

Why it works

- Clearly states years of experience and level of companies worked with - Highlights specific areas of expertise relevant to treasury roles - Includes quantifiable achievements to demonstrate impact - Mentions relevant certification (CTP) - Emphasizes strategic alignment of treasury with business goals

About

Experienced financial professional seeking a treasurer position. Skilled in cash management and financial analysis. Worked for several companies and implemented new systems. Looking for an opportunity to apply my skills in a challenging role.

Bad example

- Lacks specific details about years of experience or types of companies worked for - Doesn't highlight any specific achievements or impacts made in previous roles - Fails to mention any relevant certifications or specialized skills - Uses vague language without concrete examples of expertise - Doesn't align skills with the specific requirements of a treasurer position

What Are the Most Common Treasurer Responsibilities?

Treasurers play a crucial role in managing an organization's financial health and liquidity. While responsibilities can vary depending on the size and nature of the organization, some common treasurer duties include:

- Cash Management: Overseeing daily cash operations, optimizing cash flow, and ensuring sufficient liquidity for business operations

- Investment Management: Developing and implementing investment strategies for short-term and long-term funds

- Risk Management: Identifying and mitigating financial risks, including interest rate, foreign exchange, and credit risks

- Debt Management: Managing the organization's debt portfolio, including issuing new debt and maintaining relationships with creditors

- Banking Relationships: Establishing and maintaining relationships with banks and other financial institutions

- Financial Planning and Analysis: Conducting financial analysis and forecasting to support strategic decision-making

- Treasury Systems Management: Implementing and overseeing treasury management systems and technologies

- Compliance and Reporting: Ensuring compliance with financial regulations and preparing treasury-related reports for management and stakeholders

- Working Capital Management: Optimizing accounts payable, accounts receivable, and inventory management to improve cash flow

- Mergers and Acquisitions Support: Providing financial analysis and support for M&A activities from a treasury perspective

What Your Treasurer Resume Experience Should Include

When detailing your work experience on a treasurer resume, focus on highlighting your achievements and the impact you've made in previous roles. Here's what to include:

- Job title, company name, location, and dates of employment

- Specific responsibilities that demonstrate your expertise in treasury management

- Quantifiable achievements that show the impact of your work (e.g., cost savings, efficiency improvements, risk reduction)

- Implementation of treasury systems or processes that improved operations

- Experience managing teams or collaborating with other departments

- Involvement in strategic financial decision-making

- Any experience with industry-specific challenges or regulations

Treasurer Resume Experience Examples

Experience

Senior Treasurer

Global Manufacturing Corp.

06/2015 - Present

Chicago, IL

- Led treasury operations for a $5B multinational manufacturer, managing global cash positions across 20 countries

- Implemented a new treasury management system, resulting in a 40% improvement in cash forecasting accuracy and $10M annual cost savings

- Developed and executed a comprehensive FX hedging strategy, reducing currency risk exposure by 60%

- Structured and negotiated a $1B revolving credit facility, improving liquidity position and reducing interest expenses by $5M annually

- Spearheaded the adoption of virtual account structures, streamlining cash management processes and reducing bank fees by 30%

- Managed a team of 10 treasury professionals, fostering a culture of innovation and continuous improvement

Why it works

- Clearly states the job title, company name, location, and dates of employment - Highlights specific responsibilities that demonstrate expertise in treasury management - Includes quantifiable achievements with specific metrics (e.g., 40% improvement, $10M savings) - Demonstrates experience with key treasury functions like FX hedging and credit facility management - Shows leadership experience and ability to drive innovation in treasury operations

Experience

Treasurer

Company XYZ

2018 - 2022

New York, NY

- Managed cash for the company

- Worked on investment strategies

- Helped with risk management

- Prepared financial reports

- Attended meetings with banks

Bad example

- Lacks specific details about the company size or industry - Uses vague descriptions of responsibilities without demonstrating impact or expertise - Doesn't include any quantifiable achievements or specific projects - Fails to highlight any leadership experience or strategic contributions - Misses opportunities to showcase specific treasury skills or technologies used

What's the Best Education for a Treasurer Resume?

The educational background for a treasurer typically includes a strong foundation in finance, accounting, or a related field. Here's what you should consider including in the education section of your treasurer resume:

- Bachelor's Degree: A bachelor's degree in Finance, Accounting, Economics, or Business Administration is usually the minimum requirement for treasurer positions.

- Master's Degree: Many employers prefer candidates with advanced degrees, such as a Master of Business Administration (MBA) with a concentration in Finance, or a Master of Science in Finance.

- Relevant Coursework: If you're early in your career, you might want to list relevant coursework that demonstrates your knowledge in areas like financial management, investment analysis, risk management, and international finance.

- Continuing Education: Include any relevant professional development courses or workshops you've completed, especially those focused on treasury management or financial technologies.

Remember to list your educational qualifications in reverse chronological order, starting with the most recent. Include the name of the institution, the degree earned, and the graduation date. If you graduated with honors or maintained a high GPA (typically 3.5 or above), you may want to include this information as well.

What's the Best Professional Organization for a Treasurer Resume?

Professional organizations can demonstrate your commitment to the field and provide valuable networking and learning opportunities. For treasurers, some of the best professional organizations to include on your resume are:

- Association for Financial Professionals (AFP): This is one of the most recognized organizations for treasury and finance professionals. Membership in AFP can be particularly valuable if you hold or are pursuing the Certified Treasury Professional (CTP) designation.

- International Group of Treasury Associations (IGTA): This global organization connects treasury associations worldwide and can be particularly relevant if you're involved in international treasury management.

- Financial Executives International (FEI): While not exclusively for treasurers, this organization is valuable for senior financial professionals and can demonstrate your broader financial leadership capabilities.

- Treasury Management Association of Canada (TMAC): For those working in or with Canadian markets, membership in TMAC can be beneficial.

- Industry-Specific Treasury Associations: Depending on your sector, there might be industry-specific treasury organizations, such as the National Association of Corporate Treasurers (NACT) for corporate treasurers.

When listing professional organizations on your resume, include your membership status and any leadership roles or significant contributions you've made within the organization. This can help demonstrate your active engagement in the treasury profession beyond your day-to-day job responsibilities.

What Are the Best Awards for a Treasurer Resume?

Including relevant awards on your treasurer resume can significantly enhance your professional profile and demonstrate recognition of your expertise. Here are some prestigious awards that would be impressive to include:

- Treasury Today's Adam Smith Awards: These global awards recognize best practices and innovation in corporate treasury.

- Association for Financial Professionals (AFP) Pinnacle Award: This award recognizes excellence in treasury and finance.

- EuroFinance Award for Treasury Excellence: These awards celebrate outstanding achievements in international treasury.

- Global Finance Magazine's Treasury & Cash Management Awards: These recognize the world's best treasury and cash management providers and leaders.

- TMI Awards for Innovation & Excellence in Treasury: These awards highlight innovative solutions and best practices in treasury.

- Industry-specific awards: Depending on your sector, there may be industry-specific awards that recognize excellence in financial management or treasury operations.

- Company or regional awards: Don't overlook internal company awards or regional recognitions that demonstrate your impact and leadership in treasury management.

When listing awards on your resume, include the name of the award, the awarding organization, and the year received. If the award isn't widely known, consider briefly explaining its significance or the achievement it recognizes.

What Are Good Volunteer Opportunities for a Treasurer Resume?

Volunteer experience can demonstrate your commitment to community service and your ability to apply your financial skills outside of your primary job. Here are some volunteer opportunities that could be valuable for a treasurer's resume:

- Nonprofit Board Treasurer: Serving as a treasurer on a nonprofit board allows you to use your financial skills to support a cause you care about while gaining leadership experience.

- Financial Literacy Programs: Volunteering to teach financial literacy in schools or community centers shows your ability to communicate complex financial concepts to non-experts.

- Pro Bono Financial Consulting: Offering your treasury and financial management expertise to small nonprofits or startups can demonstrate your ability to apply your skills in diverse contexts.

- Volunteer Income Tax Assistance (VITA) Program: Helping low-income individuals with tax preparation shows your knowledge of tax regulations and your commitment to community service.

- Mentoring Programs: Mentoring students or early-career professionals in finance demonstrates leadership and your commitment to developing talent in the field.

- Community Development Financial Institutions (CDFIs): Volunteering with CDFIs can show your understanding of financial inclusion and community economic development.

- Professional Association Committees: Volunteering on committees for treasury or finance professional associations demonstrates your engagement with the broader professional community.

When including volunteer experience on your resume, focus on roles that are relevant to treasury or finance and highlight any leadership positions or significant achievements in these roles.

What Are the Best Hard Skills to Add to a Treasurer Resume?

Hard skills are specific, teachable abilities that are easy to quantify and are often required to perform job duties effectively. For a treasurer, the following hard skills are particularly valuable:

- Cash Management: Proficiency in managing cash flows, bank reconciliations, and liquidity forecasting.

- Financial Analysis: Ability to analyze financial data, create financial models, and generate insightful reports.

- Risk Management: Experience in identifying, assessing, and mitigating financial risks, including foreign exchange, interest rate, and credit risks.

- Investment Management: Knowledge of investment strategies and portfolio management for short-term and long-term funds.

- Treasury Management Systems: Familiarity with treasury workstations and enterprise resource planning (ERP) systems like SAP, Oracle, or Kyriba.

- Financial Modeling: Proficiency in building complex financial models using tools like Excel or more advanced software.

- Debt Management: Experience in managing corporate debt, including issuance, compliance, and relationship management with creditors.

- Foreign Exchange (FX) Management: Skills in managing foreign currency exposures and implementing hedging strategies.

- Working Capital Optimization: Ability to improve cash conversion cycles through management of accounts payable, accounts receivable, and inventory.

- Banking Systems and Protocols: Knowledge of banking products, SWIFT messaging, and electronic funds transfer systems.

- Regulatory Compliance: Understanding of financial regulations and reporting requirements (e.g., SOX, IFRS, GAAP).

- Data Analytics: Proficiency in using data analytics tools to derive insights from financial data.

- Cybersecurity: Understanding of cybersecurity principles as they relate to financial transactions and data protection.

When listing these skills on your resume, consider providing context or examples of how you've applied these skills in your previous roles. This can help demonstrate your proficiency and the impact of your skills in real-world scenarios.

What Are the Best Soft Skills to Add to a Treasurer Resume?

Soft skills are personal attributes that enable someone to interact effectively with others and are crucial for success in leadership roles like that of a treasurer. Here are some of the best soft skills to highlight on a treasurer resume:

- Leadership: Ability to guide and motivate a team, often across multiple departments or regions.

- Communication: Excellent verbal and written communication skills, including the ability to explain complex financial concepts to non-finance stakeholders.

- Strategic Thinking: Capacity to align treasury operations with overall business strategy and foresee long-term financial implications.

- Problem-Solving: Ability to analyze complex financial situations and develop effective solutions.

- Decision Making: Skill inmaking timely and sound financial decisions, often under pressure.

- Attention to Detail: Precision in financial calculations and reporting to ensure accuracy and compliance.

- Adaptability: Flexibility to adjust strategies in response to changing market conditions or organizational needs.

- Collaboration: Ability to work effectively with various departments, from operations to legal, to achieve financial objectives.

- Negotiation: Skills in negotiating with banks, vendors, and other financial partners to secure favorable terms.

- Ethical Judgment: Strong sense of integrity and ability to make ethical decisions in financial matters.

- Time Management: Capability to prioritize tasks and meet deadlines in a fast-paced financial environment.

- Analytical Thinking: Aptitude for analyzing complex financial data and drawing meaningful insights.

- Stress Management: Ability to remain calm and focused under pressure, especially during financial crises or market volatility.

When incorporating these soft skills into your resume, it's most effective to demonstrate them through specific examples or achievements rather than simply listing them. For instance, instead of just stating "Strong leadership skills," you might mention "Led a cross-functional team to implement a new treasury management system, improving efficiency by 30%."

What Are the Best Certifications for a Treasurer Resume?

Professional certifications can significantly enhance a treasurer's resume by demonstrating specialized knowledge and commitment to the field. Here are some of the most valuable certifications for treasurers:

- Certified Treasury Professional (CTP): Offered by the Association for Financial Professionals, this is one of the most recognized certifications for treasury and finance professionals.

- Chartered Financial Analyst (CFA): While broader in scope, this certification is highly regarded and demonstrates deep knowledge of investment management and financial analysis.

- Certified Public Accountant (CPA): This certification, while more focused on accounting, can be valuable for treasurers, especially those involved in financial reporting and compliance.

- Financial Risk Manager (FRM): Offered by the Global Association of Risk Professionals, this certification is particularly relevant for treasurers focused on risk management.

- Certified Cash Manager (CCM): This certification, while less common, specifically focuses on cash management skills.

- Certified in Treasury Management (CTM): Offered by the Treasury Management Association of Canada, this is valuable for those working in or with Canadian markets.

- Association of Corporate Treasurers (ACT) qualifications: These UK-based qualifications, such as the AMCT Diploma in Treasury, are highly regarded, especially in Europe and the Commonwealth countries.

- Project Management Professional (PMP): This certification can be valuable for treasurers involved in large-scale financial projects or system implementations.

When listing certifications on your resume, include the full name of the certification, the issuing organization, and the date of certification or expected completion date if you're in the process of obtaining it. If you've maintained the certification through continuing education, you might also mention this to show your commitment to ongoing professional development.

Tips for an Effective Treasurer Resume

To create a standout treasurer resume, consider the following tips:

- Tailor your resume to the specific job: Analyze the job description and align your skills and experiences with the requirements.

- Quantify your achievements: Use specific numbers and percentages to demonstrate the impact of your work, such as cost savings or efficiency improvements.

- Highlight your technical skills: Showcase your proficiency with treasury management systems, financial modeling tools, and other relevant software.

- Demonstrate strategic thinking: Emphasize instances where you've contributed to strategic financial decisions or aligned treasury operations with broader business goals.

- Show progression: If you've advanced in your career, make sure your resume reflects your growing responsibilities and achievements.

- Include relevant keywords: Incorporate industry-specific terms and skills to pass through applicant tracking systems (ATS).

- Proofread carefully: Ensure there are no errors in your resume, as attention to detail is crucial for a treasurer.

- Keep it concise: Aim for a one-page resume if possible, or two pages maximum for more experienced candidates.

- Use a clean, professional format: Choose a layout that is easy to read and highlights your most important information.

- Include a strong summary: Start with a compelling professional summary that encapsulates your key qualifications and career highlights.

How Long Should I Make My Treasurer Resume?

The ideal length for a treasurer resume depends on your level of experience and the specific requirements of the position you're applying for. Here are some general guidelines:

- Entry-level to mid-career professionals (0-10 years of experience): Aim for a one-page resume. This forces you to be concise and highlight only your most relevant experiences and achievements.

- Experienced professionals (10+ years of experience): A two-page resume is acceptable and often necessary to adequately showcase your extensive experience and accomplishments. However, ensure that the most crucial information appears on the first page.

- Senior executives or those with extensive publications or speaking engagements: A two to three-page resume might be appropriate, but consider creating a separate CV for academic or speaking credentials if they're extensive.

Regardless of length, focus on quality over quantity. Each item on your resume should add value and demonstrate why you're the ideal candidate for the treasurer position. Remember to tailor your resume to the specific job, which may mean adjusting the length to emphasize the most relevant experiences.

What's the Best Format for a Treasurer Resume?

The best format for a treasurer resume depends on your career stage and the specific requirements of the position. However, there are three main formats to consider:

- Chronological Format: This is the most common and typically the best choice for most treasurer positions. It lists your work history in reverse chronological order, starting with your most recent job. This format is ideal if you have a strong, consistent career progression in treasury or finance.

- Functional Format: This format focuses on your skills and abilities rather than your work history. It can be useful if you're changing careers or have gaps in your employment. However, it's generally less preferred by employers and applicant tracking systems (ATS).

- Combination Format: This blends elements of both chronological and functional formats. It begins with a strong summary of skills and qualifications, followed by a reverse-chronological work history. This can be effective for experienced treasurers who want to highlight specific skills while also showing career progression.

For most treasurer positions, the chronological or combination format is recommended. These formats allow you to showcase your career progression and recent achievements, which are typically what employers are most interested in.

Regardless of the format you choose, ensure your resume is clean, well-organized, and easy to read. Use consistent formatting throughout, with clear section headings and bullet points to break up text. Remember to use a professional font and maintain adequate white space to enhance readability.

What Should the Focus of a Treasurer Resume Be?

The focus of a treasurer resume should be on demonstrating your ability to manage an organization's financial resources effectively and strategically. Here are key areas to emphasize:

- Financial Strategy: Highlight your experience in developing and implementing financial strategies that support overall business objectives.

- Cash Management: Emphasize your skills in optimizing cash flow, liquidity management, and working capital.

- Risk Management: Showcase your ability to identify, assess, and mitigate financial risks, including foreign exchange, interest rate, and credit risks.

- Investment Management: Highlight your experience in managing investment portfolios and maximizing returns while maintaining appropriate risk levels.

- Debt Management: Demonstrate your expertise in corporate debt, including issuance, compliance, and relationship management with creditors.

- Technology and Innovation: Emphasize your experience with treasury management systems and your ability to leverage technology to improve treasury operations.

- Leadership and Team Management: Showcase your ability to lead and develop treasury teams and collaborate with other departments.

- Regulatory Compliance: Highlight your knowledge of financial regulations and your experience in ensuring compliance.

- Quantifiable Achievements: Focus on specific, measurable results you've achieved, such as cost savings, efficiency improvements, or risk reductions.

- Industry-Specific Knowledge: If applying for a treasurer position in a specific industry, emphasize any relevant industry experience or knowledge.

Remember to tailor your resume to the specific job description, highlighting the skills and experiences that best match the employer's needs. Use strong action verbs and specific examples to illustrate your capabilities and impact in previous roles.

Conclusion

Crafting an effective treasurer resume requires a strategic approach that showcases your financial expertise, leadership skills, and ability to drive organizational success through sound treasury management. By highlighting your achievements, demonstrating your technical and soft skills, and tailoring your resume to each specific opportunity, you can be a top candidate for treasurer positions. Remember to keep your resume up-to-date with the latest industry trends and continue to develop your skills to stay competitive in this dynamic field. With a well-crafted resume and a commitment to excellence in treasury management, you'll be well-equipped to advance your career and significantly impact your next treasurer role.

Sign-up for Huntr to streamline your job search and take the next step in your treasury career.

Get More Interviews, Faster

Huntr streamlines your job search. Instantly craft tailored resumes and cover letters, fill out application forms with a single click, effortlessly keep your job hunt organized, and much more...

AI Resume Builder

Beautiful, perfectly job-tailored resumes designed to make you stand out, built 10x faster with the power of AI.

Next-Generation Job Tailored Resumes

Huntr provides the most advanced job <> resume matching system in the world. Helping you match not only keywords, but responsibilities and qualifications from a job, into your resume.

Job Keyword Extractor + Resume AI Integration

Huntr extracts keywords from job descriptions and helps you integrate them into your resume using the power of AI.

Application Autofill

Save hours of mindless form filling. Use our chrome extension to fill application forms with a single click.

Job Tracker

Move beyond basic, bare-bones job trackers. Elevate your search with Huntr's all-in-one, feature-rich management platform.

AI Cover Letters

Perfectly tailored cover letters, in seconds! Our cover letter generator blends your unique background with the job's specific requirements, resulting in unique, standout cover letters.

Resume Checker

Huntr checks your resume for spelling, length, impactful use of metrics, repetition and more, ensuring your resume gets noticed by employers.

Gorgeous Resume Templates

Stand out with one of 7 designer-grade templates. Whether you're a creative spirit or a corporate professional, our range of templates caters to every career aspiration.

Personal Job Search CRM

The ultimate companion for managing your professional job-search contacts and organizing your job search outreach.